Private Wealth Services Tailored for You

Investment Program Design & Management

After a thoughtful review of your unique objectives and needs, your dedicated financial consultant will design and implement your personalized investment program. Backed by our institutional due diligence framework, your program is constructed utilizing strategies and investment managers our investment committee has rigorously vetted.

Comprehensive Financial Planning

Our planning process serves as a comprehensive evaluation of your financial life. We collaborate to identify income distribution needs, expense evaluation and budgeting, tax planning, as well as estate and protection planning. Financial planning is an ongoing process and we work together to keep your plan and investment program aligned.

Tax Management Services

We analyze our client’s investment programs and income streams to identify tax-savings opportunities and deploy tax-smart strategies to help mitigate the tax liability often related to taxable accounts such as trusts, individual and joint accounts. Our team works together with experienced outside tax professionals to navigate complex tax situations.

Risk/Projection Planning

As life is often unpredictable, our team will guide you through a risk management analysis to identify steps you can take to protect your family and navigate uncertainty together. Careful protection planning can offer peace of mind for you and your loved ones.

Estate & Wealth Transfer Planning

Our financial consultants work with you to align your estate plan with your overall financial plan to ensure your legacy is transferred in a smart and thoughtful manner. This includes regular beneficiary designation reviews, assistance in creating a will or trust and collaborating with estate planning attorneys on complex planning scenarios.

Family Meetings & Education

Education is key when passing on a legacy and planning for the future. When applicable, we make proactive introductions to your family members and educate them regarding the investment landscape, financial planning, budgeting, taxes and more. Routine family meetings can help ensure the next generation is prepared to carry on your legacy for years to come.

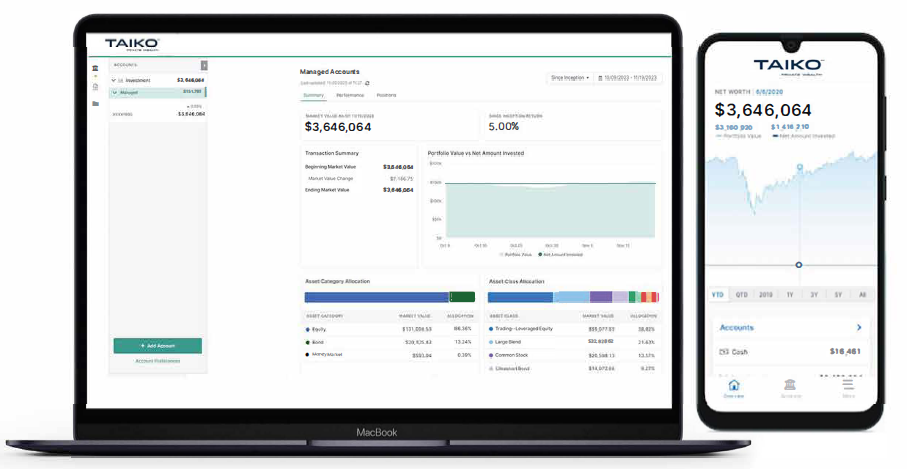

Our Client Experience

Complete Access to Your Financial Life